Incurred Cost Submissions

Understanding Incurred Cost Submission (ICS) Requirements

Understanding Incurred Cost Submission (ICS) Requirements

- Incurred Cost Submission (ICS), also sometimes called an Incurred Cost Proposal (ICP) or Indirect Cost Rate Proposal (ICRP).

- ICS is essential for accurate contract settlements and federal acquisition regulations (FAR) compliance.

- An ICS submission includes various schedules containing detailed information about a contractor's incurred direct and indirect costs in a project during a fiscal year.

- The purpose of ICS is to ensure that the costs charged to government contracts are reasonable, allowable, and allocable.

- An Incurred Cost Submission (ICS) proposal reconciles the differences between government payments and a contractor's actual costs. This reconciliation ensures that the government uses authorized/appropriated funds only for allowable costs as defined by the Federal Acquisition Regulation (FAR) and are in accordance with the terms of fully executed contract between federal agency and the contractor’s contract, agreement, purchase order, modifications, and other agreed-upon terms with the contractor.

Who is required to submit ICS?

Primary contractors and sub-contractors with flexibly priced contracts with the U.S. government must submit an ICS proposal. Flexibly priced contracts include cost-reimbursable or time and materials (FAR 16.307) with Allowable Cost and Payment clause (FAR 52.216-7(d)(2)) and/or FAR 52.232-7.

The contractor must obtain and secure the necessary documentation to support the incurred cost audits for the claimed costs.

The proposal must include a signed certificate (schedule N) certifying that all costs included in the ICS proposal are allowable as per the cost principle of the Federal Acquisition Regulation (FAR) and applicable supplements related to the contract.

Exemptions and Specific Agency Requirements

What are the threshold and deadline for submitting an ICS proposal?

- Contracts awarded after July 1, 2018, with a net value exceeding $2 million, require submission of an ICS proposal containing certified cost or pricing data. This requirement applies to all negotiated contracts with an allowable cost and payment clause, not just cost-plus projects, as per FAR clause 15.403-41.

- ontractors can request extensions from the administrative contracting officer (ACO) for exceptional circumstances. Failure to submit ICS to support allowable incurred costs within the due date can lead the ACO to make a unilateral rate recommendation as per FAR clause 52.216-7.

Who is exempt from submitting ICS?

- Contractors with contracts with no cost-reimbursable elements are not required to submit an ICS proposal as per FAR Subpart 31.2 .

- Contracts with allowable cost and payment clause awarded prior to July 1, 2018, as per FAR 51.403-41.

- Contracts with fixed-price do not require ICS submissions/

- Contracts with commercial items also do not require ICS submissions as per FAR clause 52.216-7(d)(2)(i).

What agencies need to submit ICS?

All U.S. federal agencies require ICS for applicable contracts. "Applicable contracts" refer to contracts with an "allowable cost and payment" clause as per FAR 52.216-7.

Special Cases: Time and Material & Fixed-Price Contracts

Time and material contracts

ICS submission for time and material contracts is required if the contract includes cost-reimbursable elements. Examples of cost-reimbursable elements include the following:

- Material Costs:Material costs must be supported by invoices and receipts for reimbursement.

- Labor Costs:All labor costs billed must be substantiated with timesheets and documentation.

- Travel and Relocation Expenses:All travel expenses, such as airfare, lodging, and meals, must be documented with receipts and a travel authorization for reimbursement consideration.

- Subcontractor cost:Costs incurred by subcontractors must be supported by invoices and subcontracts for reimbursement eligibility.

Fixed priced contracts

ICS submission is not required for fixed-price contracts with no provisions for indirect cost adjustments.

Mixed Contracts

If a contract has both fixed-price and cost-reimbursable elements, ICS submission is required for the reimbursable portion. Here are a few examples:

- Labor Hours: If the contract includes both fixed-price work and reimbursable labor hours (e.g., consulting services), the labor portion falls under ICS requirements.,/li>

- Materials Reimbursement: If the contract involves fixed-price deliverables that reimburse the contractor for materials or supplies used, the reimbursable material costs are subject to ICS.

- Travel Expenses: If the contract has fixed-price components but also covers travel expenses (e.g., airfare, lodging), the travel-related costs fall within FAR guidelines

Reviewing and Addition Information

Who reviews ICS submissions?

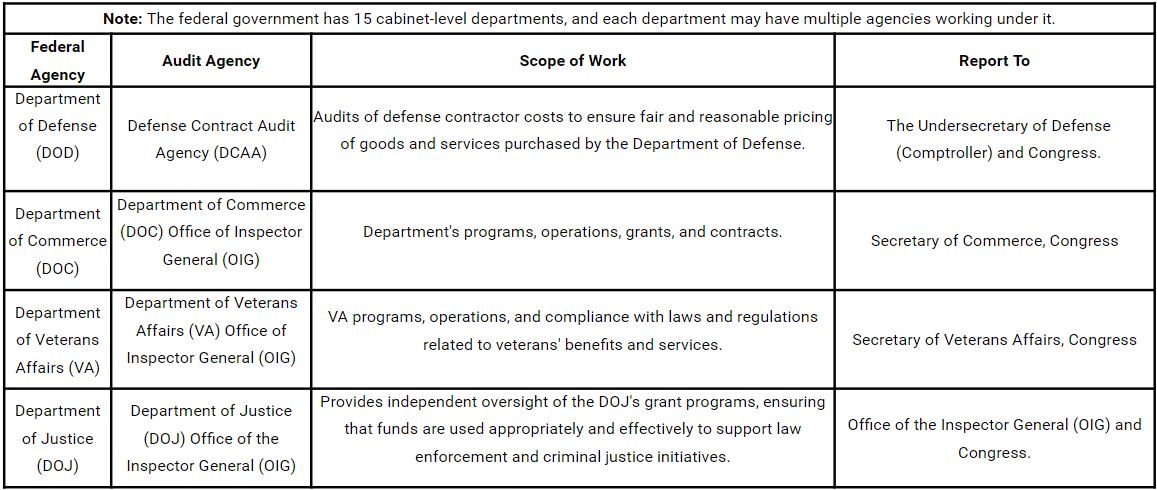

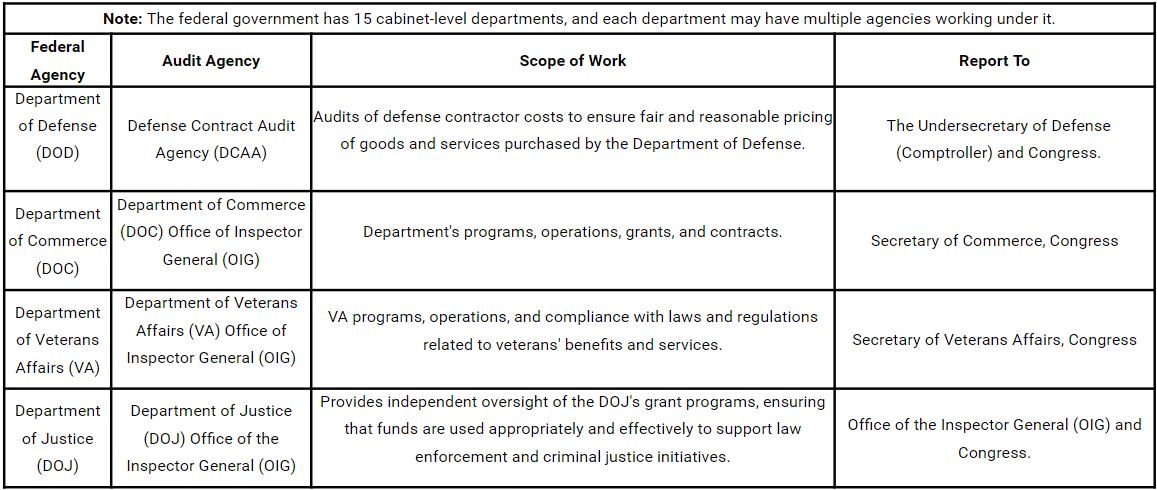

Government agencies have audit offices that review ICS submissions.

Chief Financial Officers (CFO) Act of 1990 requires 24 major federal agencies to have annual financial statement audits. The following table shows the federal auditing agencies of each department, including the difference between the scope of each agency and who they report to:

Note that all of these federal departments follow the Generally Accepted Government Auditing Standards (GAGAS). These standards are set and maintained by the Government Accountability Office (GAO) under the leadership of the Comptroller General of the United States.

- Generally Accepted Government Auditing Standards (GAGAS) are the set of auditing guidelines and principles that all individuals, agencies, departments, and private organizations conducting government audits must adhere to.

- Government Accountability Office (GAO) is a government agency working under Congress that’s responsible for the oversight and accountability of the federal government, including all federal agencies, departments, and projects. This includes creating a standardized set of audit guidelines and principles (GAGAS).

- In contrast to GAGAS, Federal Acquisition Regulation (FAR) is the set of guidelines and principles for all acquisitions that the federal government and its agencies and departments undertake. It’s basically an acquisitions rulebook for government entities. Just like GAGAS governs all audits in the federal landscape, FAR governs all acquisitions.

- The U.S. Government Accountability Office (GAO) is considered the top auditing agency at the federal level. The GAO is an independent, nonpartisan agency that works for Congress. Referred to as the "congressional watchdog," the scope of GAO is broad, conducting audits and investigations across the entire federal government.

- Under GAO, audit offices support each department/agency & establishments supporting their respective department.

What FAR clauses should contractors be looking for in their contracts to comply with ICS?

What actions should a contractor take to ensure compliance with ICS?

Compliance with ICS requirements is essential for accurate cost reporting that is reasonable, allowable, and allocable. To ensure compliance with ICS, a contractor should:

- Understand the type of contract, agreement, PO, etc.

- Period of performance, funded value, ceiling value, etc.

- Understand the reporting requirements, thresholds, and deadlines.

- Thoroughly review the contract terms, including any relevant FAR clauses and provisions related to cost or pricing data.

- Keep detailed records/supporting documents of all costs incurred during contract performance.

- Familiarize yourself with FAR clauses related to ICS, such as 52.216-7 (Allowable Cost and Payment).

Understanding Incurred Cost Submission (ICS) Requirements

Understanding Incurred Cost Submission (ICS) Requirements